updated 05-23-2020

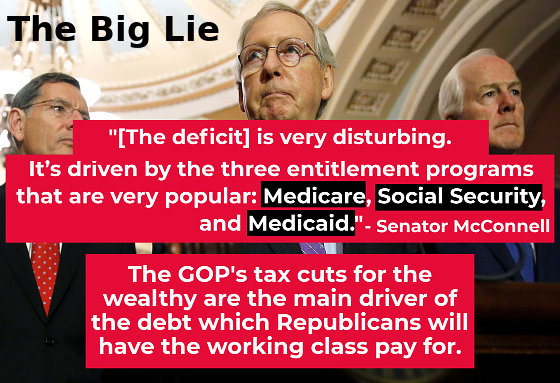

The GOP’s debt concerns were pure fraud.

The full cost of the law is now estimated at $1.9 trillion by the Congressional Budget Office – above the legal 1.5 limit.

and it actually encourages offshoring of American jobs.

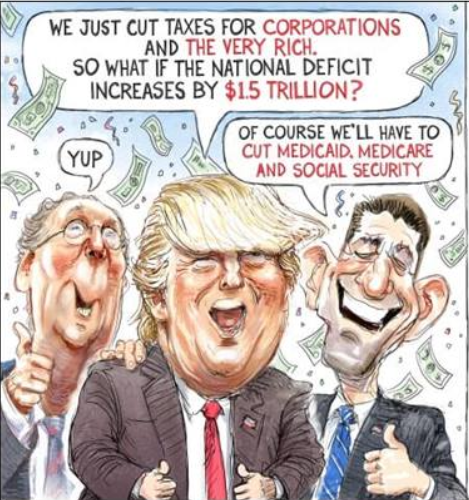

Republican leaders plan to tackle the increasing deficit not by reversing their tax cuts for the wealthy and corporations but by cutting public services for working families, especially Social Security, Medicare and Medicaid.

After one year under the new law, corporations are mostly using their actual and anticipated tax cuts and their rising profits to buy back their own stock, which principally further enriches wealthy shareholders and top corporate executives.

The ten biggest U.S. drug companies could save $75 billion in taxes on the profits that they have spent years stashing offshore to avoid taxes. Only two of these drug companies have announced they will share any of the tax cuts with workers. No drug company has said it will cut sky-high drug prices to help patients.

americansfortaxfairness.org

The Tax Act is a Christmas tree of special-interest tax breaks for the super-rich. The only thing more corrupt than the substance was the way it was enacted.

[Republicans in Congress are making us pay their rich benefactors taxes, taking our Social Security and Medicare that came out of our paycheck, our FICA.]

“Republicans just have a deep, unreasoning hatred of the idea that government policy may help some people get health care. . . .

Republicans in congress want to have the whole thing [ACA, health care] declared unconstitutional in court and have no intention of coming up with an alternative health care plan – even at Trump’s request.

Friday, May 22, 2020

A proposal by senate Republicans is nothing but a stealth attack on Social Security and Medicare. … Republicans once again claim to be concerned about the growing budget deficit – after granting an irresponsible-irrational 1.9 trillion dollar tax cut to billionaires.NCPSSM vocally condemned the “TRUST Act” when it was unveiled last year, warning that—if passed—the measure “would likely result in cuts to the earned benefits of seniors, people with disabilities, and survivors.”

For the first time in history, 2018, U.S. billionaires paid a lower tax rate than the bottom 50% of US households!

www.washingtonpost.com/business/2019/10/08/first-time-history-us-billionaires-paid-lower-tax-rate-than-working-class-last-year/

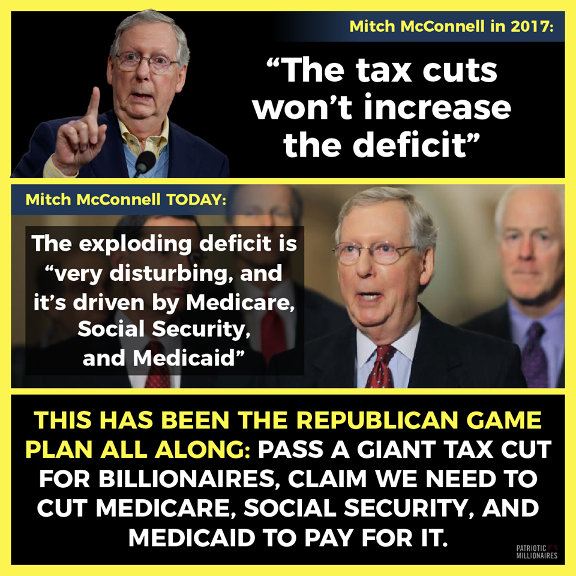

Rush Limbaugh just admitted the whole thing was a conservative con job, telling a caller: “All this [republican] talk about concern for the deficit and the budget has been bogus for as long as it’s been around.”

https://www.cnn.com/2019/07/23/opinions/under-trump-spending-is-growing-faster-than-under-obama-avlon/index.html

When it comes to Trump’s proposed changes to Medicaid and Social Security, the intent is unambiguous: These are cuts to benefits.

www.newsweek.com/deficit-budget-tax-plan-social-security-medicaid-medicare-entitlement-1172941

03-12-2019

“After exploding the deficit with his GOP tax scam for the rich, Trump [and Republicans] are once again trying to ransack Medicare, Medicaid and the health care of seniors and families across America,”

The head of a major hospital association pushed back hard, saying in a blog that “arbitrary and blunt” Medicare cuts would have a “devastating” impact on care for seniors.

“Hospitals are less and less able to cover the cost of care for Medicare patients; it is no time to gut Medicare,” said Chip Kahn of the Federation of American Hospitals.

Any clear-sighted look at Social Security’s finances, free of politically motivated spin, shows that the program is in strong shape. It has a reserve fund to pay all benefits until 2034 without any change in current policy.

Oct 16, 2018,

Senate Republicans Set Sights On Cutting Social Security

Today Senate Leader Mitch McConnell said that Republican leaders will focus on cutting Social Security, Medicare, and Medicaid.

Republican Senate leader, McConnell, tells the truth: He’ll gut Social Security and Medicare

Posted Oct 29, 2018.

The preferred GOP fix for the massive deficit created by their tax plan is to take an axe to Medicare, Social Security, and Medicaid.

The Tax Act is expected to add $1.9 trillion to the deficit over 10 years.

The balanced budget amendment has been a staple of the GOP playbook going back at least to Newt Gingrich’s 1994 Contract with America.

https://www.vox.com/policy-and-politics/2017/12/2/16724978/gop-tax-bill-deficit-debt-fraud

https://www.politico.com/story/2018/04/10/budget-hypocrisy-conservatives-republicans-512463

https://www.forbes.com/sites/teresaghilarducci/2018/10/16/senate-republicans-set-sights-on-cutting-social-security

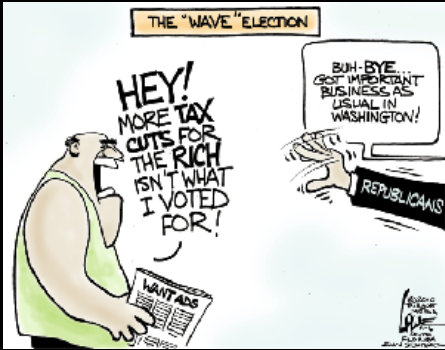

The law showered massive new tax cuts on the wealthy and corporations at a time of rising inequality, record after-tax corporate profits, unmet domestic needs, and rising deficits. These tax cuts were deeply unpopular with the American people, but demanded by the Republican Party’s political donors. Given the basic mismatch between what the American people wanted on taxes and what Republicans were delivering, congressional leaders made two strategic decisions to force their bill through Congress: They fundamentally misrepresented its contents, and they sought to move it through Congress as fast as possible with minimal public scrutiny—creating a process accessible only to well-funded lobbies. The result was a massive windfall for corporate America and the wealthy, one that preserved some of the most egregious tax loopholes while carving out new ones, at the long-term expense of working Americans.

Large tax cuts for corporations and wealthy Americans are extremely unpopular. According to a Pew poll taken in April 2017, the thing that troubled people most about the federal tax system was not the amount they paid in taxes, nor the complexity of the system. By huge margins, the top complaints were that some corporations and wealthy people do not pay their fair share. Last year, Gallup found that 63 percent of Americans believed that upper-income Americans pay too little in taxes, and 67 percent believed that corporations pay too little. Last fall, as the tax push began to heat up, more than twice as many Americans wanted to raise tax rates on large businesses and corporations as Americans who wanted to lower them. Even most Republicans wanted to either raise corporate tax rates or keep them where they were.

some tax bill proponents candidly admitted that what they were really afraid of was the wrath of their campaign donors.

Top donors like Texas financier Doug Deason explicitly threatened to stop the money flow for Republican incumbents unless they enacted the tax bill.

http://prospect.org/article/how-tax-act-embodies-republican-culture-corruption